Hey there, budget warriors! Are you tired of feeling like your money’s got a mind of its own? Well, today’s your lucky day because we’re diving headfirst into the world of gomyfinance.com create budget. This platform is not just another budgeting tool—it’s your personal financial assistant that’s got your back. Whether you’re trying to save for that dream vacation or just want to stop living paycheck to paycheck, gomyfinance.com is here to help you take control of your cash flow. Let’s get started, shall we?

Now, let’s be real for a sec. Budgeting can feel like pulling teeth, but it doesn’t have to be that way. With gomyfinance.com, creating a budget becomes less of a chore and more of a game-changer. This platform makes budgeting accessible, easy, and dare I say, fun? Yeah, I said it—fun. So, if you’re ready to level up your financial game, stick around because we’re about to break it all down for you.

Before we dive deeper, let’s talk about why budgeting matters. It’s not just about tracking expenses or cutting costs—it’s about building a solid foundation for your financial future. gomyfinance.com create budget gives you the tools you need to make smarter financial decisions, so you can focus on what truly matters. Whether it’s paying off debt, saving for a rainy day, or investing in your dreams, this platform has got you covered. Ready to see how it works?

- Xxxxxx Is Equal To 2025 The Hidden Equation Thatrsquos Shaping Our Future

- Bollyflixspa The Ultimate Guide To Your Favorite Bollywood Movie Destination

What is gomyfinance.com All About?

Alright, let’s get into the nitty-gritty of gomyfinance.com. At its core, this platform is designed to help you create a budget that works for you. No more guessing games or spreadsheets that make your head spin. gomyfinance.com simplifies the budgeting process by offering intuitive tools, real-time tracking, and customizable features that adapt to your unique financial situation. Think of it like having a financial coach in your pocket—one that never sleeps and is always ready to help you stay on track.

Here’s the kicker: gomyfinance.com doesn’t just focus on budgeting. It also provides insights into your spending habits, offers personalized tips, and even helps you set financial goals. This holistic approach ensures that you’re not just managing your money but also growing it. Whether you’re a budgeting newbie or a seasoned pro, this platform has something for everyone.

Why Choose gomyfinance.com for Budgeting?

There are plenty of budgeting apps out there, but gomyfinance.com stands out for a reason. Here’s why:

- Astrid Nelsia The Rising Star You Need To Know

- Daisy Melnin The Rising Star Redefining Creativity And Passion

- Easy to Use: Even if you’ve never budgeted a day in your life, gomyfinance.com makes it simple to get started.

- Real-Time Tracking: Say goodbye to outdated spreadsheets. With gomyfinance.com, you can track your expenses as they happen.

- Customizable Features: Tailor your budget to fit your lifestyle, not the other way around.

- Financial Insights: Get actionable insights into your spending habits so you can make smarter decisions.

Plus, gomyfinance.com create budget is built with security in mind. Your financial data is encrypted and protected, so you can focus on building your future without worrying about your information falling into the wrong hands. Pretty cool, right?

How to Create a Budget with gomyfinance.com

Creating a budget with gomyfinance.com is as easy as pie. Here’s a step-by-step guide to get you started:

Step 1: Sign Up and Set Up Your Profile

The first step is signing up for an account. Don’t worry—it’s quick and painless. Once you’re in, take a moment to set up your profile. This is where you’ll input your income, expenses, and financial goals. The more accurate your information, the better gomyfinance.com can tailor its recommendations to your needs.

Step 2: Connect Your Accounts

Connecting your bank accounts, credit cards, and other financial accounts is a breeze with gomyfinance.com. This allows the platform to automatically track your transactions, so you don’t have to lift a finger. Just sit back and let gomyfinance.com do the heavy lifting.

Step 3: Categorize Your Expenses

gomyfinance.com create budget lets you categorize your expenses so you can see exactly where your money is going. From groceries to entertainment, every transaction is neatly organized, making it easy to spot areas where you can cut back.

Step 4: Set Financial Goals

Whether you want to save for a down payment on a house, pay off student loans, or build an emergency fund, gomyfinance.com helps you set realistic financial goals. The platform even provides a timeline and actionable steps to help you achieve them.

Step 5: Monitor and Adjust

Budgeting isn’t a set-it-and-forget-it kind of thing. With gomyfinance.com, you can monitor your progress in real-time and make adjustments as needed. Life happens, and your budget should be flexible enough to adapt to changes.

Top Features of gomyfinance.com

gomyfinance.com create budget is packed with features that make budgeting a breeze. Here are some of the standout features you need to know about:

- Expense Tracking: Keep tabs on every penny you spend with real-time tracking.

- Goal Setting: Set and achieve your financial goals with personalized recommendations.

- Customizable Categories: Organize your expenses the way you want to.

- Bill Reminders: Never miss a payment again with automatic bill reminders.

- Financial Reports: Get detailed reports on your spending habits and progress.

These features work together to give you a comprehensive view of your financial health, empowering you to make informed decisions.

Who Should Use gomyfinance.com?

gomyfinance.com create budget is perfect for anyone looking to take control of their finances. Whether you’re a:

- Young Professional: Starting your career and trying to build a solid financial foundation.

- Family on a Budget: Managing household expenses and saving for the future.

- Freelancer: Juggling multiple income streams and expenses.

- Retiree: Ensuring your savings last throughout your golden years.

No matter who you are or where you are in your financial journey, gomyfinance.com has something to offer. It’s a versatile tool that grows with you as your financial needs evolve.

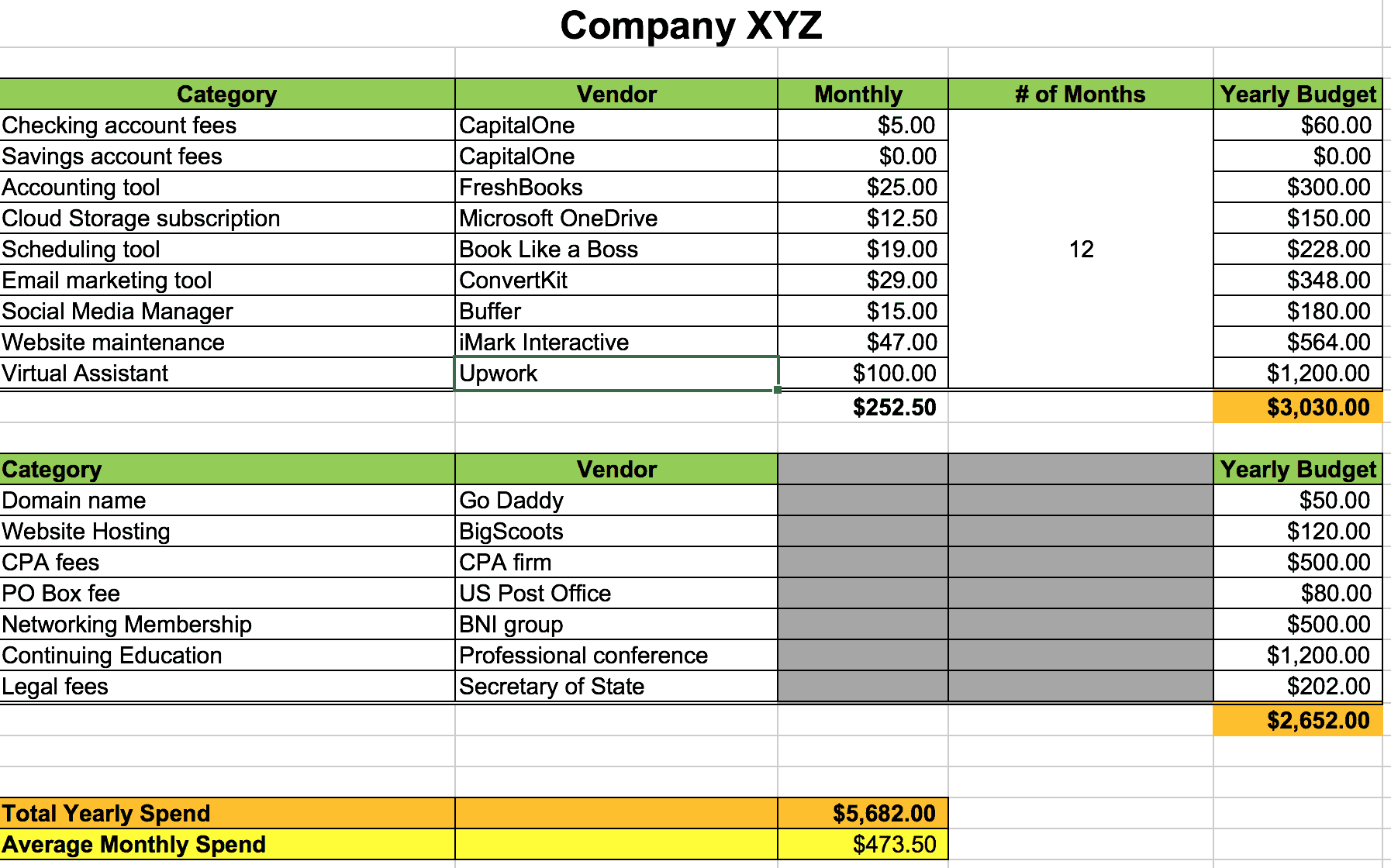

Why Budgeting is Essential

Let’s talk about why budgeting is such a big deal. Budgeting isn’t just about saving money—it’s about creating a roadmap for your financial future. With gomyfinance.com create budget, you can:

- Reduce stress by taking control of your finances.

- Pay off debt faster by identifying areas to cut back.

- Save for short-term and long-term goals.

- Invest in your future with confidence.

Think of budgeting as a superpower. It gives you the ability to make your money work for you, instead of the other way around. And with gomyfinance.com, you don’t have to do it alone.

Common Budgeting Mistakes to Avoid

Even the best budgeters make mistakes from time to time. Here are some common budgeting pitfalls to watch out for:

- Not Tracking Expenses: If you don’t know where your money’s going, you can’t control it.

- Setting Unrealistic Goals: Be honest about what you can achieve in a given timeframe.

- Ignoring Irregular Expenses: Don’t forget about things like car repairs or medical bills.

- Not Reviewing Your Budget Regularly: Life changes, and so should your budget.

gomyfinance.com create budget helps you avoid these mistakes by providing tools and insights that keep you on track. It’s like having a personal financial coach who’s always looking out for you.

Testimonials from gomyfinance.com Users

Don’t just take our word for it. Here’s what some real gomyfinance.com users have to say:

“gomyfinance.com has completely transformed the way I manage my money. I used to dread budgeting, but now it’s become a part of my routine.” – Sarah M.

“The real-time tracking feature is a game-changer. I can finally see exactly where my money’s going and make adjustments on the fly.” – John D.

“Setting financial goals with gomyfinance.com has been incredibly motivating. I’m on track to pay off my student loans six months early!” – Emily R.

These testimonials are just a few examples of how gomyfinance.com create budget is helping people take control of their finances.

Final Thoughts and Call to Action

There you have it, folks! gomyfinance.com create budget is your ultimate budgeting partner. Whether you’re trying to save for a dream vacation, pay off debt, or build an emergency fund, this platform has everything you need to succeed. So, what are you waiting for? Sign up today and start your journey to financial freedom.

Before you go, we’d love to hear from you. Have you tried gomyfinance.com? What’s your favorite feature? Leave a comment below and let us know. And don’t forget to share this article with your friends and family—because who doesn’t need a little help with their budget?

Table of Contents

- What is gomyfinance.com All About?

- Why Choose gomyfinance.com for Budgeting?

- How to Create a Budget with gomyfinance.com

- Top Features of gomyfinance.com

- Who Should Use gomyfinance.com?

- Why Budgeting is Essential

- Common Budgeting Mistakes to Avoid

- Testimonials from gomyfinance.com Users

- Final Thoughts and Call to Action

Detail Author:

- Name : Prof. Danial Gorczany DDS

- Username : hvandervort

- Email : cyril.rau@mayer.org

- Birthdate : 1987-01-31

- Address : 21819 Alda Junction East Myriamland, IL 65471

- Phone : +1 (667) 673-8998

- Company : Lemke-Goodwin

- Job : Power Distributors OR Dispatcher

- Bio : Alias nihil odit impedit explicabo sed et suscipit. Nostrum nobis non et. Omnis consequatur officiis architecto eos. Consequatur sit deserunt ea voluptatem aut dignissimos fugiat velit.

Socials

instagram:

- url : https://instagram.com/rogelio_xx

- username : rogelio_xx

- bio : Labore sit aut excepturi voluptas architecto. Iste dolores atque eos dolorum placeat minima.

- followers : 6795

- following : 2100

tiktok:

- url : https://tiktok.com/@rogelio_greenfelder

- username : rogelio_greenfelder

- bio : Impedit amet error expedita aut veniam aspernatur.

- followers : 4079

- following : 1608

linkedin:

- url : https://linkedin.com/in/greenfelderr

- username : greenfelderr

- bio : Sunt reiciendis architecto incidunt eligendi.

- followers : 3584

- following : 168